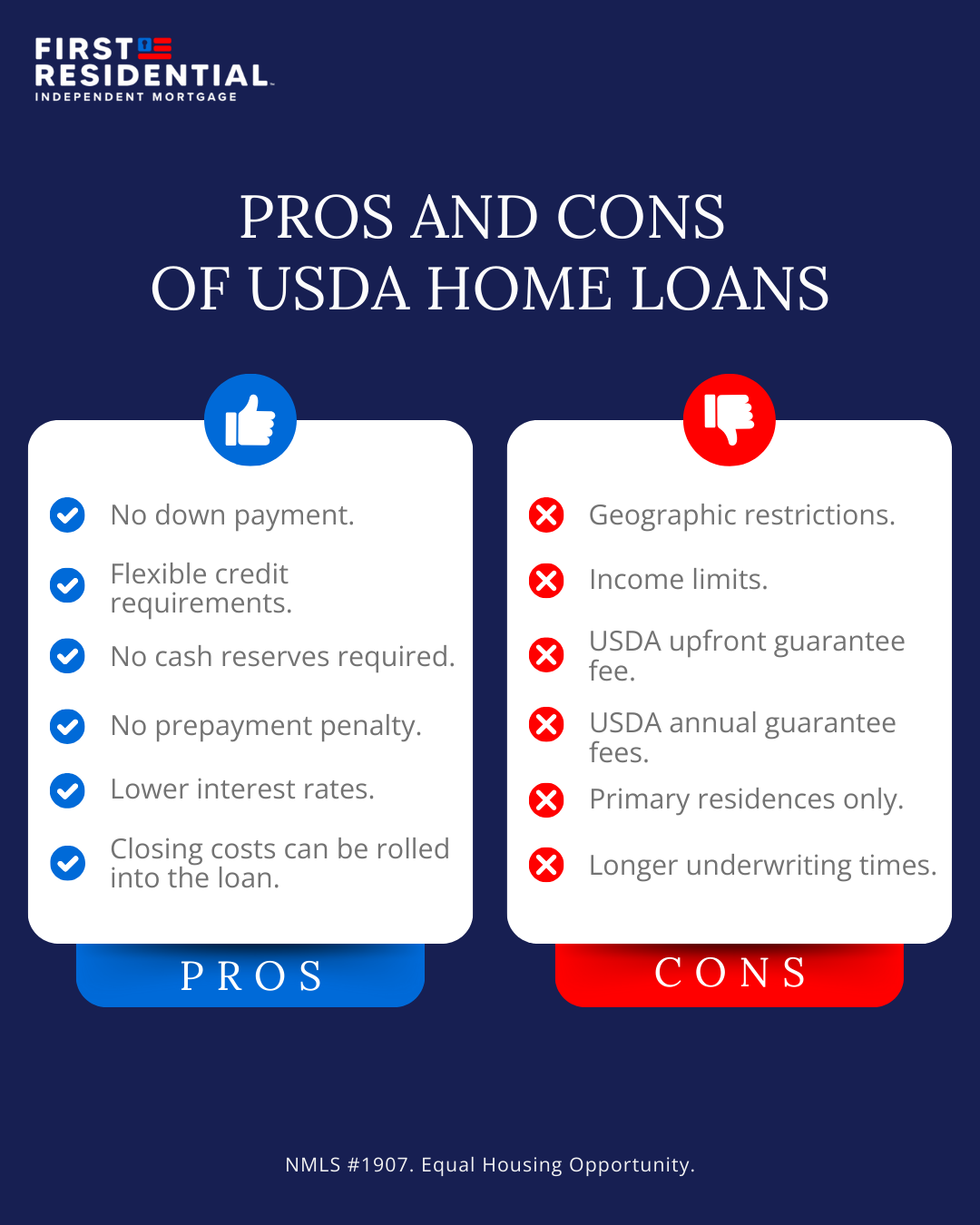

USDA Loan Pros and Cons

Reviewed by

Grant Portra, Risk Advisor

USDA loans are great for homeowners in a qualifying geographic area who have a low-to-moderate income

USDA loans have many benefits, including no required down payment, lower interest rates, and adjustable credit requirements

USDA loans are a great way of making homeownership possible in rural areas when you don’t have money saved for a down payment. That’s right, you can own a home with a $0 down payment.

You may be thinking, “Well, I don’t live in a rural area.” The good news is the USDA’s definition of “rural” is more flexible than you might think. In addition to houses in the country that you would traditionally consider rural, homes in towns, villages, and even some suburbs could qualify for a USDA loan.

Before you can decide if this home loan program is the right fit for you, you need to understand the pros and cons of the USDA loan. There are lots of benefits of USDA loans, but no loan program is a perfect fit for all buyers.

There are several important advantages of USDA loans to consider. Let’s break them down for you.

USDA loans provide many buyers with the opportunity to own a home with no down payment.

The federal government insures USDA loans, which means lenders take on less risk. As a result, lenders are willing and able to finance a greater portion of the purchase, typically 100% of the purchase in most cases.

By contrast, FHA loans require at least 3.5% down, and conventional loans often require 3–20% depending on your credit and financial situation. USDA’s 0% down advantage is one of the biggest differentiators for buyers with limited savings.

Want to know how much home you could afford with $0 down? Try our Affordability Calculator.

If you’re nervous about qualifying for a home loan because of a few negative marks on your credit report, USDA loans may still be an option for you. Again, lenders don’t have to worry as much about you repaying your loan when the federal government insures the mortgage, so they’re able to relax their credit requirements for USDA borrowers.

That said, USDA loans are designed for moderate- to low-income borrowers, and some lenders may still set their own minimum credit scores to manage risk.

Compared to other loan types, USDA loans tend to fall in the middle in terms of credit flexibility. Conventional loans typically require higher scores, while FHA loans allow lower scores but often come with higher mortgage insurance costs. USDA loans aim to strike a balance between accessibility and responsible lending through their government-backed structure.

USDA guidelines and most lender policies do not require cash reserves for approval. However, there are situations where a lender may ask for reserves if a borrower needs additional compensating factors to offset other weaknesses in their file. In contrast, some other loan types, such as FHA manual underwrites, require at least one month of reserves. For most USDA borrowers, though, no cash reserves are needed to qualify.

Some loan types charge you a fee if you decide to pay off your mortgage early. If you pay off your loan early, the lender misses out on the interest income they were counting on, so this fee helps them recoup some of that income. But with USDA loans, there’s no penalty.

Loans with low down payment requirements, such as the conventional loan, may carry a higher interest rate if the borrower has a lower credit score. However, with the government backing your loan, lenders can keep your USDA interest rates low, as they assume less risk. Lower interest rates result in lower monthly payments and less interest expense over the loan's term.

Typically, USDA loans offer interest rates that are as low as or lower than those of FHA and conventional loans, especially for borrowers with average credit. Conventional loans may penalize borrowers with lower scores by charging higher rates, and FHA loans often incur additional insurance costs that increase the effective monthly payment.

Curious what your monthly payment could look like with a USDA loan? Use our Mortgage Calculator to run the numbers.

Many buyers are surprised to find that closing costs typically account for around 3-5% of the home’s purchase price. On a $250,000 home, that would be $7,500-$12,500, which is a significant amount of money to have sitting around. However, with a USDA loan, you can include this cost in your loan, so you don’t have to pay it out of pocket upfront. Under certain market conditions, you can sometimes negotiate with the seller to cover your closing costs, effectively eliminating this expense from your plate.

With conventional and FHA loans, you typically need to pay closing costs upfront or negotiate with the seller. USDA’s option to roll them into the loan makes it more accessible if you don’t have a large amount of cash on hand.

Note: First Residential and USDA guidelines permit closing costs to be financed into the loan amount, up to the appraised value, when the appraised value exceeds the purchase price.

Of course, we cannot ignore the potential downsides when considering the pros and cons of USDA loans. As a homebuyer, it’s important to get a well-rounded explanation of the mortgage options available to you. Here are some of the potential issues with USDA loans:

If you want to buy a home in the heart of a major city, USDA loans aren’t for you. Urban properties fall outside of the qualifying geographic areas. However, many towns fall within the USDA property eligibility map, especially if you’re looking at towns of fewer than 35,000 people.

By comparison, FHA and conventional loans can be used anywhere, including urban areas, while USDA loans are limited to eligible rural and suburban properties.

One goal of the USDA home loan program is to help low-to moderate-income buyers find homes. For this reason, there is an income limit, meaning you can actually make too much money to qualify for a USDA loan. In 2026, income is limited to $119,850 for homes with 1-4 members. For homes with 5-8 members, the income limit is $158,250.

USDA loans require an upfront guarantee fee for processing. This fee equals 1% of the loan amount. Rather than paying this fee at closing, you can roll the cost into the loan and pay it off in installments through your monthly mortgage payments.

In addition to your upfront guarantee fee, you'll need to pay recurring USDA program fees. These fees are currently equal to 0.35% of the loan amount. Rather than paying a lump sum each year, you can choose to pay this amount in monthly installments with your mortgage payments.

The good news is that you can use USDA loans for multiple property types, including single-family homes, newly constructed homes, condos, and manufactured homes, as long as you make the property your primary residence. The not-so-good news is that you can’t use a USDA loan for:

Vacation homes

Multi-family homes (like duplexes, triplexes, or apartments, even if one of the units is your primary residence)

Investment properties

Non-residential real estate

There are lots of details lenders need to check when you apply for a USDA loan, so it can potentially take longer to underwrite the loan than if you were to use a conventional home loan. If you’re in a rush to close on a home, this may not be the option for you.

You’ve got questions, we’ve got answers!

For the right buyer, absolutely. USDA loans are hard to beat if you qualify geographically and meet income limits. If you don’t, FHA loans may be a strong low-down-payment alternative, while conventional loans may be better for those with higher credit scores and more savings.

Now that you understand the advantages and disadvantages of the USDA loan, you’re one step closer to getting the financing needed to buy a home.

Ready to take the next step? Get your quote today to see if a USDA loan works for you.

Tyler Oswald is a Production Training Team Lead at First Residential, where she’s revamped training to make it more effective and engaging. With a strong background in FHA, Conventional, and USDA home loans, she’s all about equipping loan teams with the tools they need to succeed while keeping things collaborative and aligned with First Residential'se values.

More articles by Tyler OswaldThis website uses technologies such as cookies and pixels to improve site functionality, as well as for analytics and advertising. By continuing, you agree to our use of cookies and pixels. Learn more about our use of cookies and pixels in our privacy policy.