How Do Mortgage Loans Work?

Reviewed by

Grant Portra, Risk Advisor

Understanding how mortgages work helps make the homebuying process more achievable.

Choosing the right loan type and structure depends on your budget, goals, and how long you plan to stay in the home.

A mortgage is a type of loan used to purchase a property, allowing you to spread payments over many years instead of paying the full cost upfront.

Several types of mortgages are available, including conventional, FHA, VA, and USDA loans. Each option offers unique benefits depending on your credit score, income, and long-term goals.

Before committing to one, it is important to know what a mortgage entails and how it fits into your overall financial plan.

When deciding which mortgage types to consider, it helps to start by understanding what a mortgage is and how repayment structures can differ. A mortgage is a loan used to purchase property, and one of the most important choices you make involves how you repay that loan.

The two most common structures are fixed-rate and adjustable-rate mortgages, and each one affects how your payment and overall costs evolve. Understanding these differences helps you choose the structure that best suits your goals and comfort level.

An adjustable-rate mortgage (ARM) begins with a fixed interest rate for a specified period and then adjusts periodically based on market conditions. For example, a 5/1 ARM keeps your rate steady for 5 years and then adjusts annually thereafter.

So, if interest rates rise, your payment may increase; if they fall, it may decrease. This type of loan can work well if you plan to sell or refinance before the rate changes or if you expect rates to drop in the future.

On the other hand, a fixed-rate mortgage stays the same throughout the entire life of your loan. This structure provides predictability because your monthly principal and interest payments never change.

Many homeowners prefer a fixed-rate mortgage because it makes budgeting easier and offers long-term peace of mind. However, if you take one out when rates are high, you could end up paying more over time, unless you later refinance.

For example, if you purchase a home when rates are 7%, a fixed-rate mortgage locks you into that rate even if national rates fall to 5% later. However, someone with an adjustable-rate mortgage might see their payment drop automatically as rates adjust downward.

Two of the most popular fixed-rate mortgage options are 15-year and 30-year loans. While both allow you to own your home outright at the end of the term, they differ in payment size and total interest costs.

A 15-year mortgage lets you repay the loan in half the time of a 30-year, meaning you pay less interest overall. However, the monthly payments are higher because you spread the loan balance across fewer years.

A 30-year mortgage offers lower monthly payments because the repayment period is longer. Although you pay more in interest, this option undoubtedly provides greater budget flexibility and may make it easier to qualify.

For example, a borrower who earns $70,000 a year may find a 30-year loan more realistic for their monthly expenses, while someone earning more with limited debt might choose a 15-year term to save on total interest. Comparing 30-year and 15-year mortgage rates before making a decision can help you choose the option that better aligns with your goals.

Both terms serve different homeowners. A first-time buyer looking to keep their payments low might opt for a 30-year mortgage, while someone buying their forever home may prefer to pay off the loan faster with a 15-year plan.

Many different types of mortgages are available to homebuyers today.

Conventional loans are the most widely used and ideal for well-qualified borrowers who meet standard credit and income requirements. Government-backed options include FHA, USDA, and VA loans, which expand access to homeownership.

An FHA loan is popular among borrowers with lower credit scores or limited savings, as it allows a down payment as low as 3.5%. A USDA loan supports rural homebuyers who meet certain income and property location requirements, while a VA loan offers a zero-down payment and no PMI for eligible Veterans and active-duty service members.

It is also important to note that any loan exceeding the local conforming loan limit is considered a jumbo loan. In most areas, this limit is $806,500, though it can be higher in certain markets such as California or New York.

| Loan Type | Conventional | FHA | VA | USDA | Jumbo |

|---|---|---|---|---|---|

| Minimum Down | 3% | 3.5% | 0% | 0% | 10% |

| Mortgage Insurance | PMI | Upfront fee + ongoing PMI | VA Funding Fee, No PMI | Upfront and annual guarantee fee | No PMI, larger reserves |

| Best For | Well-qualified buyers | Lower credit | Eligible Veterans and service members | Lower-income buyers in rural areas | High-cost homes |

| Key Limits | Fannie Mae and Freddie Mac rules | Property standards | Primary residence only | Income and location limits | Stricter documents and DTI |

Each borrower’s path looks a little different, so learning how home loans work begins with comparing the main types of mortgages. For instance, a first-time buyer in a suburban area may find an FHA loan appealing, while a Veteran purchasing near a military base could benefit from a VA loan. Jumbo loans better suit high-cost markets where home prices exceed typical limits.

Four main components make up the monthly mortgage payment. Knowing these details helps you see how mortgage loans work in practice and plan your budget more effectively.

Principal refers to the total amount borrowed. Each month, a portion of your payment applies toward reducing this amount. Over time, as the principal decreases, you build more equity in your home.

Interest is the cost of borrowing money. Your interest rate and loan balance determine the monthly payment amount. As you continue making payments, the interest portion of your payment becomes smaller, while a larger portion goes toward the principal.

Your monthly payment usually includes taxes. Lenders typically collect your full annual property tax bill by adding a small amount to each of your 12 monthly mortgage payments and holding those funds in an escrow account until taxes are due.

Homeowners insurance covers your home from damage or loss and sometimes includes mortgage insurance if required. Mortgage insurance is typically required when your down payment is below 20% for a conventional loan. Government-backed loans require additional mortgage insurance and fees. For example, FHA loans require monthly insurance, whereas VA loans require only a one-time funding fee.

Understanding these components can help you estimate what mortgage you can afford more accurately. For example, if you budget $2,000 per month for housing, knowing how much to allocate to each category helps you adjust your goals before applying.

A conforming loan is a conventional loan that meets Fannie Mae and Freddie Mac’s guidelines, including limits on the loan amount and borrower credit scores. Lenders can sell these loans to investors, allowing them to offer more competitive rates even though the government doesn’t insure them.

A non-conforming loan does not meet those limits or standards. This category includes jumbo loans and government-backed FHA, VA, and USDA loans. Buyers with lower credit scores or unique income sources may find non-conforming loans more flexible.

Mortgage qualification depends on various personal factors, such as financial stability, income, credit score, and long-term plans. Lenders also evaluate your debt-to-income ratio, down payment, and the property’s appraised value before approval.

Each borrower’s path is unique. For example, a self-employed buyer may need to provide two years of tax returns to verify income, while a salaried employee can show recent pay stubs and W-2 forms. Understanding how a mortgage loan works helps you estimate the mortgage you can afford based on your current financial situation.

Lenders order an appraisal to confirm that the property’s value supports the loan amount. This step ensures both you and the lender are making a sound investment.

Prequalification and preapproval are the next steps toward securing financing. These steps provide insight into your buying power, making you a more competitive buyer.

Prequalification is the initial step where you share basic financial information with a lender. They provide an estimate of how much you may be able to borrow based on your income and debts.

Preapproval takes it further. Here, the lender reviews your financial documents and credit report. Sellers are more likely to accept an offer from a preapproved buyer since it shows you have financing ready.

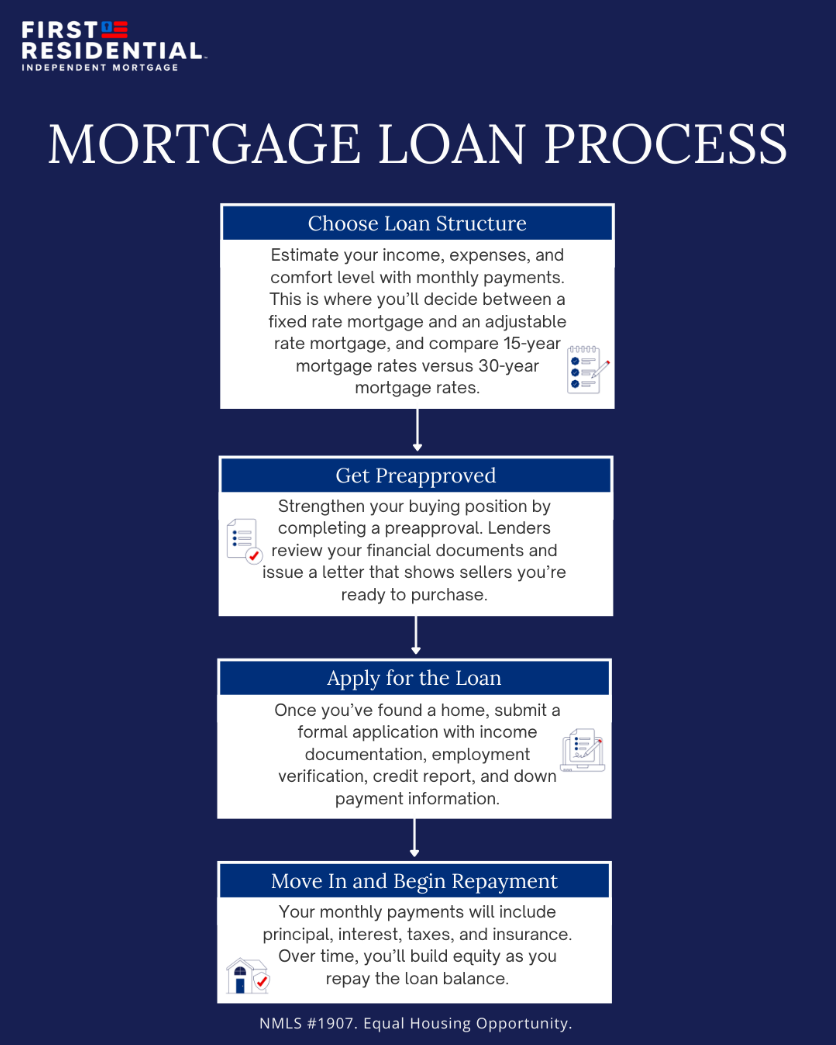

| 1. Choose Loan Structure | Estimate your income, expenses, and comfort level with monthly payments. This is where you’ll decide between a fixed-rate mortgage and an adjustable-rate mortgage, and compare 15-year mortgage rates versus 30-year mortgage rates. |

|---|---|

| 2. Get Preapproved | Strengthen your buying position by completing a preapproval. Lenders review your financial documents and issue a letter confirming that you’re ready to purchase. |

| 3. Apply for the Loan | Once you’ve found a home, submit a formal application with income documentation, employment verification, credit report, and down payment information. |

| 4. Move In and Begin Repayment | Your monthly payments will include principal, interest, taxes, and insurance. Over time, you’ll build equity as you repay the loan balance. |

Buying a home can raise many questions, and understanding how mortgage loans work can make the process less stressful. Our First Residential team has compiled and answered your top FAQS about mortgage loans.

A mortgage is a loan used to purchase a home or property, which you repay over time with interest.

You borrow money from a lender to purchase a property and repay it through monthly payments that cover the principal, interest, taxes, and insurance.

It depends on your income, credit score, debt-to-income ratio, and down payment. Check how much home you can afford today.

Most home loans take 30 to 45 days from application to closing. Timelines vary depending on how quickly you provide the documents and the loan type you apply for.

Lenders typically require W-2s, pay stubs, tax returns, identification, and bank statements.

A fixed-rate mortgage keeps the same interest rate for the life of the loan, while an adjustable-rate mortgage changes after an initial fixed period based on market conditions.

A 15-year mortgage helps you pay off your loan faster and save on interest, while a 30-year mortgage offers lower monthly payments. Comparing 15-year mortgage rates and 30-year mortgage rates can help you find the right balance between cost and comfort.

Choosing a mortgage is about matching your financial goals with your lifestyle and plans. Talk to a First Residential loan expert for insight at 1-833-919-1177 or start your quote today.

Shiloh has extensive experience with FHA and conventional loans from his time as a senior loan officer and trainer at First Residential. In his current role, he helps new loan officers understand the loan process, from approval to closing, while also coaching and supporting their growth.

More articles by Shiloh DavisThis website uses technologies such as cookies and pixels to improve site functionality, as well as for analytics and advertising. By continuing, you agree to our use of cookies and pixels. Learn more about our use of cookies and pixels in our privacy policy.